Understanding your service charges

Your service charges are annual charges that contribute to the cost of providing essential water, wastewater and drainage services to your community. Find out which service charges apply to you and how they are calculated for your property.

From 1 July 2025, a 2.5% increase will apply to water, sewerage and drainage service charges.

In line with the Gross Rental Value (GRV) revaluation, some households will see a maximum increase of 12.5% on sewerage and a limitation of $25 on metro draining service charges. Some metro businesses will see a maximum increase of 12.5% on their drainage charges.

In this article

What are my service charges?

Service charges are different from your water use charges. They are fixed charges for the services and infrastructure that are available to your property, which can include water, sewerage and drainage.

We ensure your home and community has access to these essential services:

A clean and reliable water supply

From securing our water sources to treating and pumping drinking water to your tap, we work 24 hours, 7 days a week to provide you with a reliable water supply.

Wastewater removal and treatment

We take away your household’s wastewater for treatment before it’s safely disposed of or recycled for future use.

Stormwater drainage

Our drainage network removes stormwater to prevent flooding and damage to your home. It also provides additional drainage support to existing Local Government Authority infrastructure.

To see which service charges apply to you, check the back of your bill or log in to your online account.

Did you know?

We maintain and operate over 52,000 kilometres of pipeline across WA. If our entire network was laid out in a single line, it would wrap around the Earth’s equator approximately 1.3 times!

How are service charges calculated?

Because your service charges are divided across 6 two-monthly bills for the year, the amount you pay on each bill depends on the number of days within that billing period.

To find your property’s total service charges for the current financial year, use our property water rates search tool.

Water service charge

Residential water service charges are a fixed, state-wide charge which is reviewed and set each year by the State Government.

All properties that have a Water Corporation water service available to it (including those not currently connected) are billed for this charge.

Sewerage and drainage service charges

Residential sewerage and drainage charges are based on your property's Gross Rental Value (GRV), multiplied by a rate in the dollar.

Your GRV is the gross rental income that could reasonably be expected if you were to rent out the property.

This figure is provided to us by Landgate Property Valuation Services and can be found on the back of your bill under 'Rateable value'.

The use of GRV to calculate your charges is set by law, as it’s deemed to be the fairest way to do so for properties throughout WA. See more frequently asked questions about GRV.

For metro properties, the sewerage rate in the dollar changes as the GRV increases. That is, two rates apply based on the cut-off value which reflects the median value of all property GRVs in the metro area.

For regional properties, the rate in the dollar used to calculate your sewerage charges will depend on the town or city you live in, as the cost of providing this service to different locations varies.

Example calculation of a sewerage service charge

A metro property with a GRV of $24,000 would have a sewerage charge of:

($20,000 x $0.04551) + ($4,000 x $0.03946) = $1,068.04

where $20,000 is the current cut-off value for applying the two rates.

Example calculation of a drainage service charge

A metro property with a rateable value of $25,000 would have a drainage service charge of:

$25,000 x $0.00603 = $150.75

*Based on 2025-26 pricing.

2025-26 residential service charges and rates in the dollar

| Service charge | Perth metropolitan area | Regional WA |

|---|---|---|

| Water service charge | $296.89 | |

| Sewerage service charges and rates in the dollar |

|

|

| Drainage rate in the dollar |

|

Regional properties are not charged for drainage. |

Frequently asked questions

Your sewerage service charge is based on your property’s Gross Rental Value, which is determined by Landgate, not your usage.

Even if your property isn’t connected to our sewerage service, we still need to maintain the network that is available to service your property and your community.

If you have further questions about your GRV or would like to lodge an objection against your GRV, please contact Landgate.

If you need help with your bill, we have a variety of financial support options available.

Even if your property isn’t connected to any of the services you are billed for, we still need to maintain the network that surrounds you and your community.

Learn more about vacant land charges.

The calculation of the GRV is based on many factors determined by Landgate, including:

Residential

- location

- age and size of the property

- extra facilities (including carports or below ground pools)

- proximity to services (schools, public transport, shops, main roads etc.).

Business

- location

- age, building area and construction materials

- street exposure and property access

- proximity to main arterial roads and primary commercial precincts.

For residential vacant land and other specialised properties, the rateable value is based on:

- 3% of the property's capital value, or

- the amount the land and any buildings would reasonably receive if sold.

Properties in the metropolitan area are revalued every 3 years.

Regional revaluations occur every 3 to 6 years, depending on the local government area.

Assessments may happen sooner for properties with recent additions or improvements or if the land reverts to a vacant lot.

If your property's GRV has increased after being revalued by Landgate, you may be concerned by the impact this will have on your service charges.

To avoid any sudden increases to your bill, we have caps on the amount your service charges can increase by.

For the 2024 - 2025 financial year, GRV-related increases to residential sewerage service charges are capped to a total increase of 12.5% (10% + the Consumer Price Index of 2.5%).

Increases to residential drainage service charges are capped to $25.

You can see whether your service charges have been capped on the back of your bill.

Please note: These caps don't apply to you if your GRV has increased due to an improvement in your property, such as the addition of a pool or renovations. In this case, you will be billed for the full increase in your service charges.

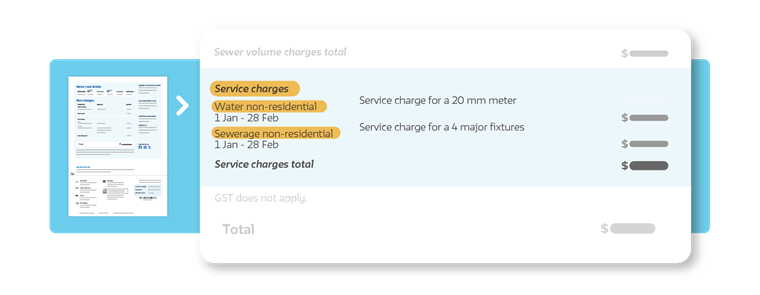

Business bills are generally made up of the following charges. On this page, you will learn about your service charges.

- Water use charge

- Sewer volume charges

- Service Charges

The breakdown of the charges that apply to you can be found on the back of your bill.

Business service charges

Your total annual service charges are divided into 6 billing periods within the financial year. We calculate the service charge component based on the number of days in each billing period.

Billing periods

- 1 July to 31 August: 62 days

- 1 September to 31 October: 61 days

- 1 November to 31 December: 61 days

- 1 January to 28 February: 59 days (60 if leap year)

- 1 March to 30 April: 61 days

- 1 May to 30 June: 61 days

Service charges breakdown

Below you will find the breakdown of how service charges are divided and more information on the available services.

Water service charges

For business properties in metro and regional areas, water service charges are based on the size and number of water meters servicing the property.

If your property is unmetered or not connected, a minimum annual water service charge of $315.50 applies (including fire services).

Water meter charges

| Meter size | Charge 2025-26 |

|---|---|

| Up to 20mm | $315.50 |

| 25mm | $493.00 |

| 30mm | $709.86 |

| Up to 40mm | $1,262.06 |

| 50mm | $1,971.94 |

| 70, 75, 80mm | $5,048.18 |

| 100mm | $7,887.76 |

| Up to 150mm | $17,747.49 |

| 200mm (metro only) | $31,551.07 |

| 250mm (metro only) | $49,298.55 |

| 300mm (metro only) | $70,989.92 |

| 350mm (metro only) | $96,625.21 |

Metro and regional strata titled storage units and bays

- The water service charge is $111.05 per strata titled parking bay or strata titled storage unit.

- The water service charge is $214.75 per strata titled or long-term residential caravan bay.

Sewerage service charges

Your sewerage service charges are based on the number of major sewerage fixtures such as toilets, urinals or pan washer.

The number of fixtures at the property is listed on your bill. If the number of fixtures changes or differs from what is shown on your bills, please contact us at rating.services@watercorporation.com.au.

Fixtures charges

| Fixtures | Charge 2025-26 |

|---|---|

| 1st fixture | $1,184.25 |

| 2nd fixture | $506.92 |

| 3rd fixture | $676.99 |

| 4th and over | $736.19 |

Strata lots sharing major fixtures

Major fixtures in a common area and shared by strata lots on the same floor are charged at a different rate.

We divide the number of major fixtures in the common area by the number of strata lots on the same floor and round down. If the result is less than 1, the tariff is $736.19 for each strata lot.

For example, if there are 5 strata lots sharing 8 major fixtures, we divide the 8 fixtures by the 5 lots

8 fixtures divided by 5 lots = 1.6 fixtures per lot.

We would round this down to 1, so the tariff for each strata lot would be $1,184.25.

Charges for strata lots with dedicated fixtures are based on fixture charges listed in the table above.

Metro and regional strata titled storage units and bays

- The sewer service charge is $117.36 per strata titled parking bay or strata titled storage unit.

- The sewer service charge is $378.70 per strata titled or long-term residential caravan bay.

Commercial nursing homes

- The sewerage service charge is $214.29 per bed.

Drainage service charges

Drainage charges are based on your property’s Gross Rental Value (GRV), or rateable value, supplied by the Valuer General and only apply to businesses in the Declared Drainage Area in the metro area. The charge is calculated by multiplying a rate (cents in the dollar) by the rateable value.

The drainage charge is 0.385 cents for each dollar of the rateable value.

For example, a property with a rateable value of $60,000 would have a drainage service charge of $60,000 x $0.00385 = $231.00.

Annual increases in business drainage service charges are capped at 10% plus CPI, e.g. 12.5% for 2025-26. The minimum drainage charge for metro business properties is $140.05.

Metro strata titled storage units and bays

- The drainage service charge is $16.20 per strata titled parking bay or strata titled storage unit.

- The drainage service charge is $42.05 per strata titled caravan bay.

Pay your service charges in full

You can select to pay your service charges in full for the current financial year in your online account.

If you pay your service charges in full, you'll be billed the outstanding service charges balance for the current financial. We'll then continue to issue a service charges bill at the start of each financial year, including the service charges for that year.

paying your service charges in full

Some businesses may be eligible for a discount on their service charges. Learn more about discounts for businesses.

Related articles

Need help with your bill?

We’re here to help make paying your bill easier. Learn more about extending your bill due date and other longer-term support options.